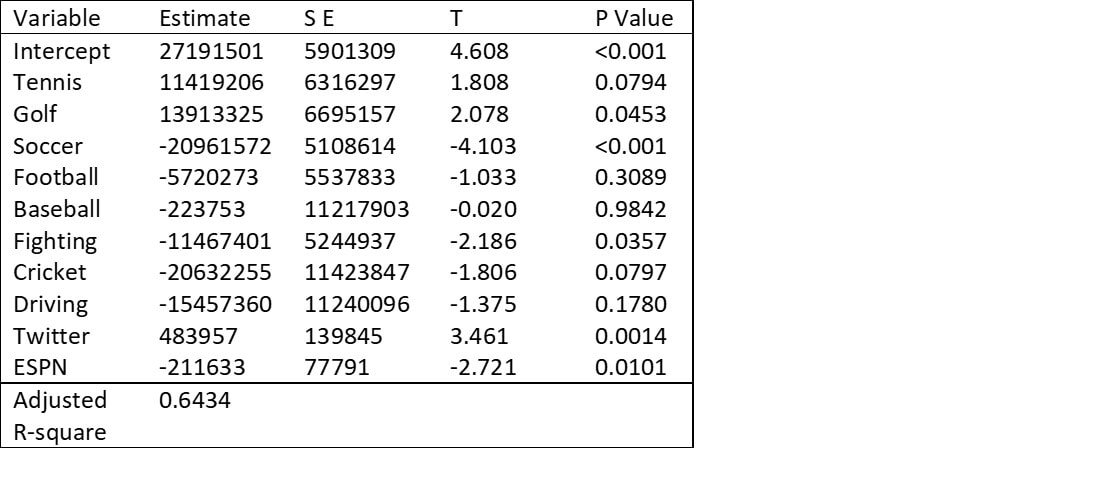

We know that athlete endorsers can generate substantial additional revenue from their corporate partnerships, but what determines the magnitude? Most people can name several elite performers in their sport who are also key brand endorsers, but what about others? Is there an increase for playing a certain sport, having more followers or being more popular? In order to determine this, a regression analysis was conducted on the top 100 athlete endorsers of 2019 as named by Opendorse. This website listed 2019 endorsement earnings, sport and number of Twitter followers. Next, athlete popularity was collected from ESPN who ranks the top 100 athletes by popularity. Finally, a model was run looking at earnings as determined by the sport played (with basketball as the reference sport), number of Twitter followers (in Millions) and ESPN rank (1 most popular). The results indicate that compared to basketball, tennis athlete endorsers receive an additional $11 million, golf receives about $14 million more, while crticket and soccer each receive about $21 million less and fighters receive $11 million less than basketball, with football, baseball and driving showing no difference in endorsement income. For every 1 million increase in Twitter followers, an athlete can expect to receive an $480,000 and as popularity drops, so does the amount they receive, about $200,000 per drop in rank. Overall, these results provide some evidence that not all sports are equal in terms of attracting endorsement dollars. Some sports command a premium over others. Athletes who are interested in generating additional income should be encouraged to cultivate their social media following as they are rewarded for a larger audience, which makes sense for endorsing companies trying to increase their reach. While this model predicts about 64% of endorsement dollars, there are several other features that are potentially contributing to endorsement dollars that isn’t captured. The more that athletes, their agents, and endorsing companies, understand what impacts endorsement earnings, the better able each is to represent their interests to greatest advantage.

2 Comments

Depending on the sport, athletes can generate substantial additional income as an athletic endorser, sometimes exceeding their contracts (Smith, 2019). Athletes have historically been used as a spokesperson, or endorser, for firms in the past hoping to capitalize on their appeal to their target market. In exchange for their endorsement, athletes would be compensated. Now, it is not unusual to hear that an athlete obtains an equity stake in company they endorse. If an athlete has an ownership stake in a business they partner with they have a vested interest in their performance and are more likely to actively promote the brand. As pointed out in a Sportico article, the use of equity for compensation can be expensive (John WallStreet, 2020).

The equity stake does not have to contain money up front, but as the brand grows and prospers, so does that stake. So, while the company may have cash now to reinvest in operations, or seek additional marketing strategies, the equity can be costly to the current owners over time. Moreover, any equity stake comes with an ownership vote in the future of the company. While perhaps not a threat now, it can pose a challenge if the athlete disagrees with ownership in the future and their is a public rift. Their is also additional risk to a brand in the activities of a sponsor may reflect back on a brand. It is not known how having an athlete owner will reflect on the company if their is a negative behavior attributed to the athlete. For high profile athletes with a positive rating, the potential for income is apparent, as they stand to generate millions of additional dollars in income (Rascher, Eddy, & Hyun, 2017). These athletes have an interest in maintaining their popularity as it allows them to negotiate for higher endorsement fees. As this cost rises, companies may be averse to paying them cash, and so opt for some mix of equity in exchange for their endorsements. As this landscape continues to evolve and athletes continue to look beyond their playing careers to build future financial portfolios, the use of equity to pay for endorsements will probably continue to grow. Brands will be faced with trying to determine not just how much an endorsement contract is worth, but how much a piece of the company is. References Rascher, D., Eddy, T., & Hyun, G. (2017). What drives endorsement earnings for superstar athletes? Journal of Applied Sport Management, 9(2). Smith, N. (2019, June 17). 13 athletes who make more money endorsing products than playing sports. Business Insider. Retrieved from https://www.businessinsider.com/athletes-endorsements-nba-golf-tennis-2019-6 Sportico. (2020). Start-ups, challenger brands leaning on equity-for-endorsement deals, despite soft market. Retrieved from https://view.email.sportico.com/?qs=a7e127b8dd8af188e5ed7117fc6bda871e1beb8f88758bf397e3bd0afb2ba8298ab7d347dee925944f4afda5b010a214ca050ef5f7761b1f9a00793476f784ce570e6b08dabf65cf |

AuthorI write on sport management, fitness, sports medicine and business topics to help you reach your goals Archives

February 2024

Categories

All

|

|

Home

About Contact |

To learn more about what services we offer, to schedule an appointment or to get prices please contact me at

[email protected] (607)279-6791 *This site is for educational purposes only, it is not meant to diagnose, treat or replace medical advice. Before starting an exercise program always make sure that you are healthy and able to do so safely.* |

RSS Feed

RSS Feed