|

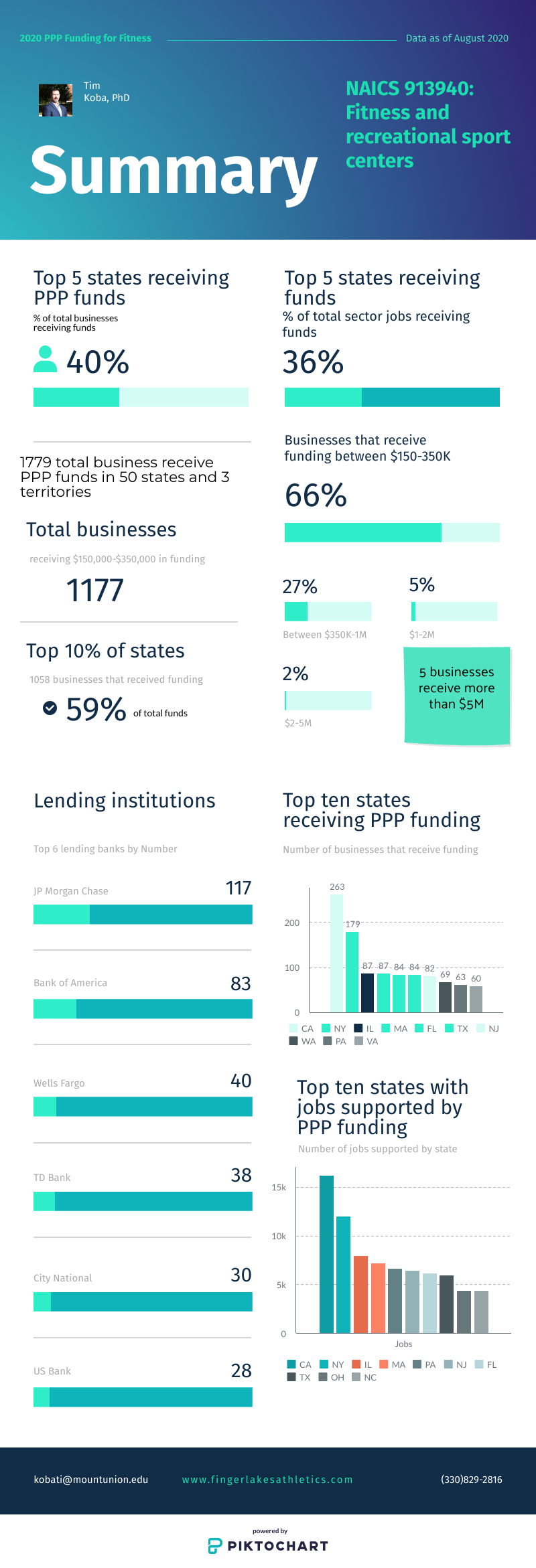

The coronavirus led to business shutdowns in an effort to contain the spread, as well as the Federal Government to pass the CARES act to help individuals and small businesses. Part of this is the Paycheck Protection Program (PPP), where banks lent money to small businesses through the Small Business Administration (SBA) with low interest and were backed by the Federal Reserve (Mercado, 2020). Generally, if at least 60% of this lent money was used to support workers, the balance of the loan could be forgiven. Overall, $525 Billion was lent through this program with the majority being smaller loans. There were 662,215 loans made to businesses in excess of $150,000 that were categorized based on level of spending and the details of the loan are publicly available (SBA). In an effort to understand who was lent money, the SBA also asked for additional details, which may not have been provided, on gender, ethnicity, veteran owned, non-profit status and lending institution.

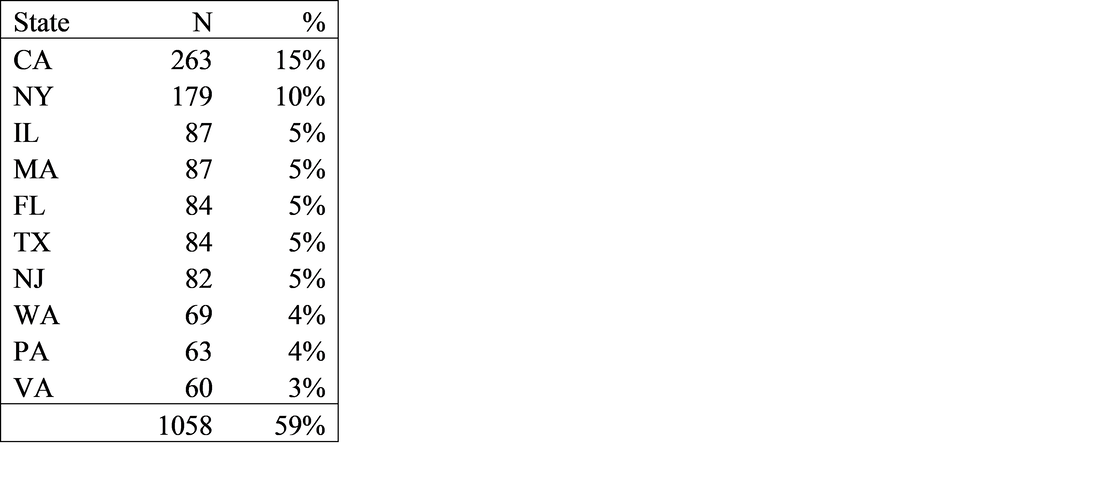

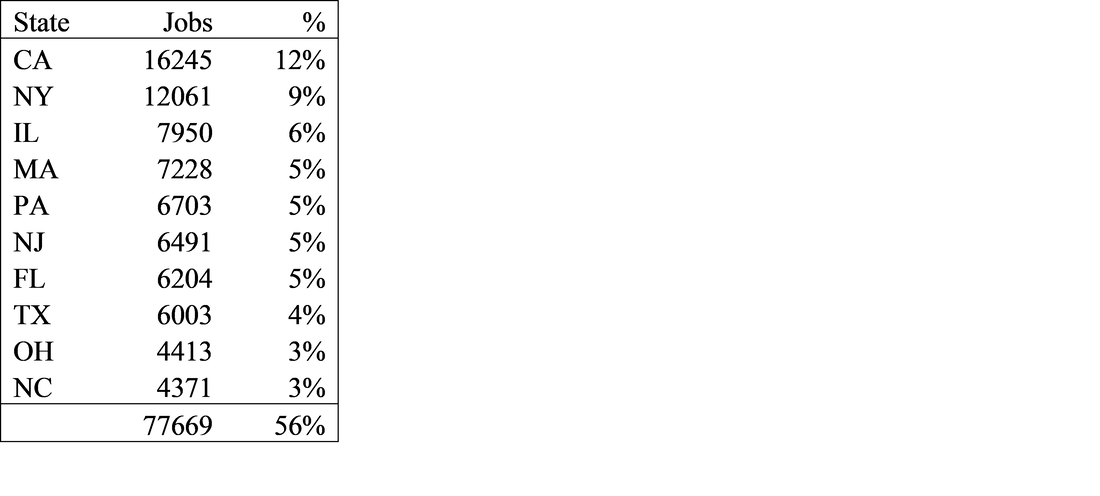

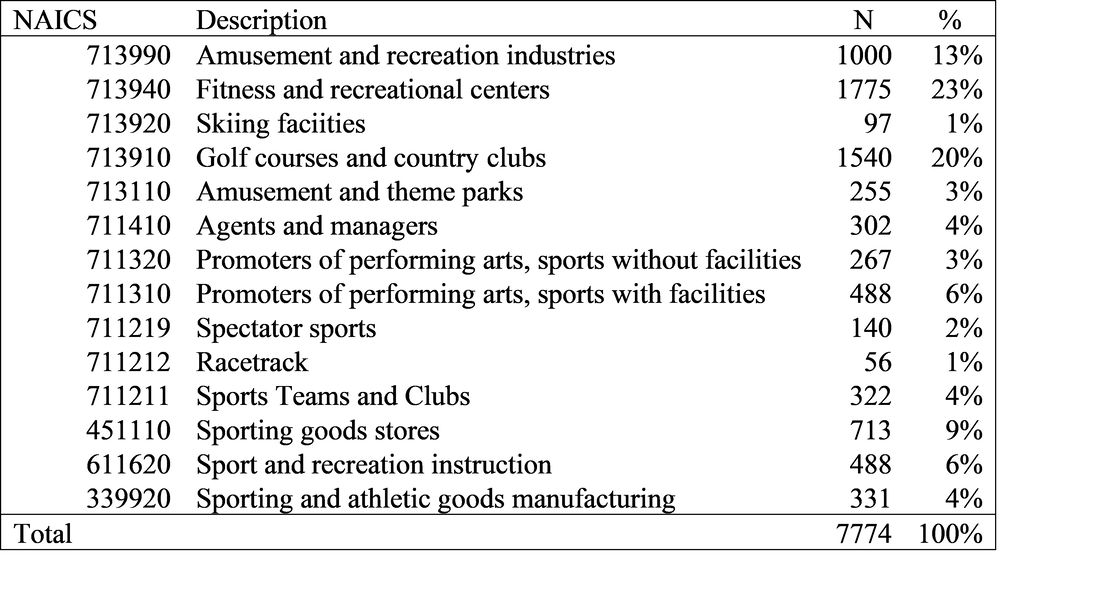

The North American Industry Classification System (NAICS) is used to classify businesses for statistical use to understand the United States Economy (U.S. Census Bureau, 2020). There are several NAICS codes that apply to sport, with the largest sector being NAICS 713940; fitness and recreational sports centers. According to NAICS data, there are 134,100 businesses in this sector which is 44% of the total number of sport and recreation related businesses (Table 1). According to leading industry trade association, the International Health, Racquet and Sportsclub Association (IHRSA), there were 39,570 gyms in 2018 (Rodriguez, 2019). Fitness and recreation were one of the sectors most impacted by the coronavirus shutdowns. To determine the PPP funds that went to the fitness and recreational sport centers, the SBA dataset was downloaded for all loans made over $150,000. This was further subdivided into the businesses that exist in the sport section and then isolated to those businesses with NAICS code 713940. The restriction to funds in excess of $150,000 was due to availability of the data, for funds less than this amount, there were higher identifiers collected and it was organized by state rather than in a single file. Results of the data illustrate that a total of 1,775 businesses in the fitness and recreational sport sector received funding in excess of $150,000 with each state, two territories (Guam and Puerto Rico) and Washington, DC represented. Funds were organized into categories with 1,177 businesses receiving funds between $150-350,000, 473 businesses receiving funds between $350,000-1 Million, 81 businesses with funding between $1-2 Million, 43 businesses with funds between $2-5Million and 5 receiving funds between $5-10 Million. There were a total of 103 (5.8%) that were listed as female owned and 217 (12.2%) categorized as non-profits. Since this was not a mandatory field to be completed, it is unknown if there were more. The states with the most businesses receiving funding are California (263), New York (179), Illinois and Massachusetts with 87 and Florida and Texas with 84. These six states represented 45% of the total businesses that received PPP funds (Table 2). Rounding out the top 10 were New Jersey (82), Washington (69), Pennsylvania (63) and Virginia (60). These ten states received 59% of the total PPP funding received for this sector. The total jobs that were supported by the PPP were 137,852. The top ten states for job support were California (16,245), New York (12,061), Illinois (7,950), Massachusetts (7,228), Pennsylvania (6,703), New Jersey (6,491), Florida (6,204), Texas (6,003), Ohio (4,413) and North Carolina (4,371). These ten states comprise 56% of the total jobs supported by PPP funding (Table 3). An assessment of the lenders show that JP Morgan Chase issued 117 loans, Bank of America issued 83, Wells Fargo issued 40, TD Bank issued 38, US Bank issued 28 and PNC Bank with 26. These are six of ten largest banks by assets in the United States (Phaneuf, 2019). City National Bank issued 30 loans, Truist and the Huntington Bank each issued 25 loans, Manufacturers and Traders Trust issued 23 loans, as did Fifth Third Bank. Unfortunately, these results do not include total funds lent to fitness and recreational sport centers, but it does provide insight into gyms that received higher levels of funds. The 1,775 businesses that received funds supported 137,852 jobs in 50 states, two territories and Washington, DC. It would appear that there are differences in where the funding went, with California and New York businesses received 25% of total funds. The top ten states of businesses receiving funding comprise 59% of total funds. The jobs supported are similar, with California and New York supporting 21% of total jobs and the top ten supporting 56% of total jobs. Two of the largest banks by assets also issued the most loans, JP Morgan Chase with 117 and Bank of America with 83. Further evaluation should attempt to determine the total number of fitness and recreational sport businesses that received funding at all levels. Since these funds are meant to provide financial support for coronavirus shutdowns and pay employees it is vital to understand the number of businesses that received these funds. Since it is also possible that these loans are eligible for forgiveness if the funds are used for approved expenses, the businesses that receive them have an advantage over those that do not. How wide spread this disparity is, is not fully known. What is known is that 66% of the funding over $150,000 was between $150-350,000. The results indicate that just 5.8% of the businesses that received funding were female owned. If this is reflective of the ownership of businesses in this sector is not known since this was not a mandatory field. If it is reflective, then much work remains to be done supporting women owned businesses in this field and their ability to acquire loans. Non-profit businesses comprised 12.2% of the total businesses. The lack of minority completed forms makes it difficult to determine the ethnic breakdown of the funds, so it would appear that more work is required. The collection and dissemination of PPP funds is helpful for understanding what businesses are receiving funds, and if this is an indication of the sector, there is a lack of female and minority owned businesses in fitness and recreational sport centers. References Mercado, D. (2020, November 2). PPP loan borrowers are being steered toward forgiveness. Why they should slow down. CNBC. https://www.cnbc.com/2020/11/02/ppp-loan-borrowers-shoved-into-forgiveness-why-they-should-slow-down.html Paycheck Protection Program loan data. (2020, August 20). U.S. Small Business Association. Phaneuf, A. (2019, August 26). Here is a list of the largest banks in the United States by assets in 2020. Business Insider. Retrieved from https://www.businessinsider.com/largest-banks-us-list Rodriguez, M. (2019, March 28). Latest IHRSA data: Over 6B visits to 39,570 gyms in 2018. IHRSA. Retrieved from https://www.ihrsa.org/about/media-center/press-releases/latest-ihrsa-data-over-6b-visits-to-39-570-gyms-in-2018/ United States Census Bureau. (2020). North American Industry Classification System. Retrieved from https://www.census.gov/eos/www/naics/

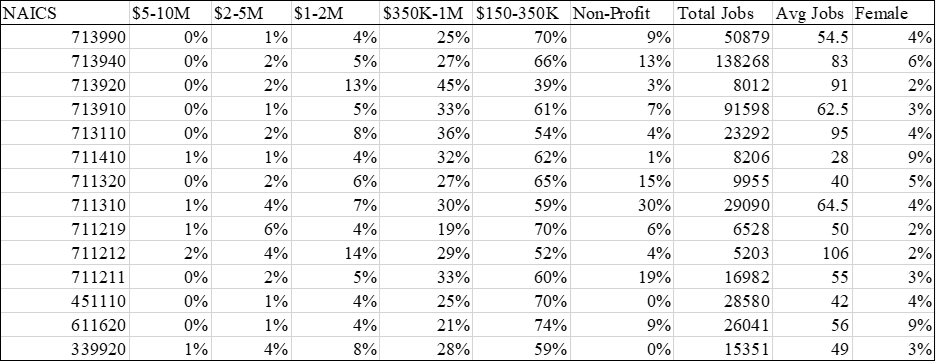

2 Comments

In early 2020 the global economy was impacted by COVID-19 which caused many states to institute lockdowns to restrict the spread of the virus (Maxouris, 2020). The sport industry was not immune to this impact, including the suspension of professional sports and the closing of fitness centers and gyms in many communities (Brooks, 2020). In order to help small businesses weather the economic impact that resulted from the shutdowns, the Payroll Protection Program (PPP) was launched to help provide small business with capital necessary to pay their employees and prevent small businesses from closing their doors. Those businesses that achieved funding were able to obtain loans at a small interest rate with deferred payments, as well as apply for loan forgiveness if the funds were used for eligible expenses and if certain employee criteria were met (SBA, 2020). There were several categories of funding available for small businesses with over 600,000 businesses receiving funding of over $150,000 according to the SBA PPP dataset. Since the sport industry, and fitness centers were impacted, a smaller subset of the data was created to identify the sport related businesses that receive funding. The data was organized based on the North American Industry Classification System (NAICS), which was developed for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy (U.S. Census Bureau, 2020). The data also included other information including the number of employees the business reported, the location, organizational structure, and demographic of the owner, when completed. The sport industry is spread over several NAICS codes with category 71 broadly including Arts, Entertainment and Recreation (NAICS Association, 2018), however, other specific sport related industries are included in other classification systems, or included broadly (sport apparel and footwear is included in the broader category and excluded). A summary is presented of the NAICS, description of the category and number of businesses that received funding (Table 1). Unsurprisingly, the fitness industry received the bulk of the funding that went to the sport industry with 1775 businesses receiving funding in excess of $150,000. One thousand amusement and recreational businesses received funding over $150,000 and 1540 golf clubs and country clubs received funding of more than $150,000. These three categories comprised 56% of the total sport related business that received PPP funding. Additionally, we can look at the composition of the sport businesses that received PPP funds (Table 2). The majority category of funding was $150-350,000 ranging from a low of 52% in racetracks to a high of 74% in sport and recreation instruction. Most of the businesses were for profit, however 30% of the businesses that received PPP funds in the Promoters of performing arts, sports with facilities category were non-profit. The categories that have the largest employees was the fitness industry (138,268) and golf and country clubs (91,598). The businesses with the greatest average employment were racetracks (106) and amusement parks (95), with skiing facilities (91) and fitness (83) close behind. Many businesses did not report on gender or minority status of the owners, but those that report gender demonstrate little female owned businesses. None of the sport categories exceed 10% as being female owned and only Agents and managers and Sport and recreation instruction are in the high single digits (9%). From this overview we can see that 7774 total businesses in the sport industry received PPP funding with the fitness sector, golf and country clubs and amusement and recreation comprising 56% of the businesses that received PPP dollars. The fitness industry is the dominant employer followed by golf and country clubs. This data was restricted to lending in excess of $150,000 and does not include funding below that level. It is not known how many more sport businesses received funding below $150,000. This data does let us see that the fitness center, although impacted, had the greatest number of businesses receiving PPP funding. While we can see funding level and number of businesses and jobs, we do not know how many other businesses applied for funding, received lower amounts of funding, or were not able to acquire funding and shuttered their doors. Most of the businesses are for-profit operators with limited female ownership, which may be a result of not completing that section on the application. If representative, it continues to demonstrate a disparity in women owned businesses acquiring capital. Minority funding was difficult to determine since there was a lack of completed information on the ethnicity question. Compiling complete data would allow for greater transparency and understanding of the businesses in sport that receive PPP funding for operations and employment support. A copy of the complete dataset complied the U.S. Treasury is available here References Brooks, K. J. (2020, March 17). As coronavirus spreads, gyms halt the workouts. CBSNews. Retrieved from https://www.cbsnews.com/news/fitness-clubs-and-gyms-are-closing-because-of-coronavirus/ Maxouris, C. (2020, March 18). These states have some of the most drastic restrictions to combat the spread of coronavirus. CNN. Retrieved from https://www.cnn.com/2020/03/17/us/states-measures-coronavirus-spread/index.html NAICS Association. (2018). Six digit NAICS codes & titles. Retrieved from https://www.naics.com/six-digit-naics/?code=71 Payroll Protection Program. (2020). Small Business Association. Retrieved from https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program U.S. Census Bureau. (2020, February 26 updated). North American Industry Classification System. Retrieved from https://www.census.gov/eos/www/naics/ |

AuthorI write on sport management, fitness, sports medicine and business topics to help you reach your goals Archives

February 2024

Categories

All

|

|

Home

About Contact |

To learn more about what services we offer, to schedule an appointment or to get prices please contact me at

[email protected] (607)279-6791 *This site is for educational purposes only, it is not meant to diagnose, treat or replace medical advice. Before starting an exercise program always make sure that you are healthy and able to do so safely.* |

RSS Feed

RSS Feed