|

When it comes to physical fitness, conditioning and resistance training, it is important to remember a couple of key principles. The SAID (specific adaptation to imposed demand) principle stipulates that adaptation is based on the stimulus applied. The second, progressive overload is that the training stimulus should remain static, but that the training variables should evolve over time to elicit a response. When programming your workouts, these principles should be kept in mind and the variables for manipulation include load (weight lifted), number of sets, number of reps, the resultant total volume, rest times between sets and between exercise bouts and training frequency. While there is a large volume of information available including scientific and non-scientific, the principles remain the same: the body adapts to the stimulus applied and this stimulus should change over time to continue to elicit a positive response. Specific to resistance training and its influence on strength and size development there is support that training with a heavier load results in positive strength gain, but does not enhance muscle growth over lighter loads (Fink et al., 2016). The majority of improvement in the first few weeks of training is related to improve neuromuscular efficiency and as the body adapts to the exercise, the parameters of training have to evolve (Schoenfeld, 2020). However, strength can also be achieved by training to momentary muscle failure where it is difficult to perform another repetition at the given weight. This type of training elicits both strength and size results as many of the muscle fibers are recruited. Thus, training can be performed with lighter loads in a repetition zone of 6-20 repetitions and still result in positive strength and size gains (Baz-Valle, Fontes-Villalba, & Santos-Concejero, 2018). There may be an individual response based on muscle fiber type that plays a role, but is hard to make generalizations. When it comes to improving muscular size, the muscles worked need to have sufficient overload to stimulate adaptation. That overload comes in the form of increased volume. Tracking volume can be done by counting the number of sets performed per muscle group per week as long as the repetitions are performed to momentary muscle failure (Fisher, Steele, Bruce-Low, & Smith, 2011). While the ideal recommendation is not available, it does appear that muscle gains are achieved with at least 10 sets performed per muscle per week (Schoenfeld & Grgic, 2018). However, performing more sets do not necessarily result in a greater muscle response indicating that there is probably a point of diminishing returns (Aube et al., 2020). Whether obtaining training volume is done in a single workout, split routine or whole-body workout does not seem to matter, as long as the volume for each program is matched. As the body adapts it becomes more important to organize the workouts to continue the positive adaptation and progression, so a split routine may be helpful in organizing workouts to obtain higher volumes in each session. There is also support that for aging individuals, the training frequency of at least three days a week is of importance (Polito, Papst, & Farinatti, 2021). Many strength coaches have adopted periodization, or the organizing of workouts to achieve adaptation, as a means of programming performance, however, it does not appear that this is important to the stimulation of muscle growth (Polito, Papst, & Farinatti, 2021). The key variable appears to be weekly volume, so periodization of the workouts can be done to prevent monotony of training, as well as overtraining, if desired. For training purposes, it can be helpful to organize the exercise in terms of movement and choose an exercise that fits that movement. The main movements are squatting, deadlifting lunging, horizontal pushing and pulling and vertical pushing and pulling. This then allows for a large variety of exercises that fall into those specific categories. A sample program is provided below. For specific muscles, it is also advisable to include additional sets and exercises, as needed and as tolerated. In general, it would appear there is a relationship between weekly volume and muscle gain, where at least 10 sets per movement are necessary to stimulate growth. It is important to train each set to momentary muscle failure to maximize the response and to progressively improve over time. This last part is where periodizing and organizing the workout may be of assistance, however not necessary so long as the weekly volume per muscle group is obtained. Do:

References: Aube, D. et al. (2020). Progressive resistance training volume: Effects on muscle thickness, mass, and strength adaptations in resistance-trained individuals. Journal of Strength and Conditioning Research, 1-8. Baz-Valle, E., Fontes-Villalba, M., & Santos-Concejero, J. (2018). Total number of sets as a training volume quantification method for muscle hypertrophy: A systematic review. Journal of Strength and Conditioning Research, 1-9. Fink, J., Kikuchi, N., Yoshida, S., Terada, K., & Nakazato, K. (2016). Impact of high versus low fixed loads and non-linear training loads on muscle hypertrophy, strength and force development. SpringerPlus, 5, 1-8. Fisher, J., Steele, J., Bruce-Low, S., & Smith, D. (2011). Evidence-based resistance training recommendations. Medicina Sportiva, 15(3), 147-162. Polito, M.D., Papst, R. R., & Farinatti, P. (2021). Moderators of strength gains and hypertrophy in resistance training: A systematic review and meta-analysis. Journal of Sports Sciences, 39(19), 2189-2198. Schoenfeld, B. J. (2020). Science and development of muscle hypertrophy. Human Kinetics. Schoenfeld, B., & Grgic, J. (2018). Evidence-based guidelines for resistance training volume to maximize muscle hypertrophy. Strength & Conditioning Journal, 40(4), 107-112.

2 Comments

Being outside and active during the winter months can be a great way to enjoy the colder, snowier months of the year. Skiing and snowboarding are popular winter activities that encourage physical activity, but are not without their risk of injury.

When looking to identify risk factors related to skiing, researchers in South Tyrol identified that men were at greater risk of injury severity than females based on visits to their clinic. Additionally, injury severity increased with age and snowboarding. Beginners reported less severe injuries than experts based on the injury severity score and the presence of fresh snowfall also decreased injury severity (Girardi, et al, 2010). Helmet usage in skiers and snowboarders is not consistent across age, as middle school aged children had higher levels of helmet use than high schoolers. Wearing a helmet has been shown to reduce the occurrence of head injuries. When wearing a helmet, high school aged participants were more likely to report injury resulting from jumps or tricks, as well as solid organ injuries (McLoughlin, et al, 2019). Based on meta-analysis of ski injury data, the researchers identified that females are at an increased risk of knee injuries in both skiing and snowboarding. Beginners reported injuries at greater rates than advanced or expert skiers, mostly as the result of a fall, while advanced and expert participants reported injuries as resulting from a jump. Wrist braces were found to reduce the rate of wrist fractures in snowboarders, but may predispose these athletes to elbow and shoulder injuries. Additionally, inclement weather, including poor visibility and terrain also increased the risk of injury (Hume, et al, 2015). Based on qualitative research with 61 stakeholders in World Cup alpine skiers, 32 perceived risk factors were identified across five categories. According to the results of the study, the five most commonly perceived risk factors are the ski/binding/plate/boot interface, changing snow conditions, speed and course settings, physical attributes including skier fitness and strength level and speed in general (Sporri, et al, 2012). Generally, injuries differ based on experience, ability, skiing and snowboarding participation, weather and whether participants are wearing a helmet. While the weather conditions are outside of personal control, how a participant responds to changing weather and surface conditions is. Increasing signage, attention and caution can help reduce the risk of injury in inclement conditions. Choosing to wear a helmet is important to reducing head injuries, as long as risk taking is not increased for jumps. Having a helmet may create a false sense of security that increases risk taking that can result in injury. Jumping carries an intrinsic risk of injury for skiers and snowboarders, whereas falling is a common cause of injury in beginners. Participating within one’s ability at a speed that can be safely handled is not only responsible, but related to reduction in injuries and collisions. Snowboarders are encouraged to wear wrist braces to protect themselves from a fall on an outstretched hand and everyone is encouraged to adequately prepare for the upcoming snow season. Increasing fitness, strength and balance are essential components of a snow sport preparation program. Age is related to injury, and while we cannot control the aging process, we can control our fitness. Take the time to prepare, get strong and gradually increase activity to enjoy not just this season, but many more seasons to come! Do: Wear a helmet Consider a wrist brace if snowboarding Pay attention and ski within your ability and avoid excessive risk taking Prepare for the season with a comprehensive strength and conditioning program Have fun! References Girardi, P., Braggion, M., Sacco, G., De Giorgi, F., & Corra, S. (2010). Factors affecting injury severity among recreational skiers and snowboarders: An epidemiology study. Knee Surg Sports Trammatol Arthrosc, 18, 1804-1809. Hume, P. A., Lorimer, A. V., Griffiths, P. C., Carlson, I., & Lamont, M. (2015). Recreational snow-sports injury risk factors and countermeasures: A meta-analytic review and Haddon matrix evaluation. Sports Med, 45, 1175-1190. McLoughlin, R. J., Green, J., Nazarey, P. P., Hirsch, M. P., Cleary, M., & Aidlen, J. T. (2019). The risk of snow sport injury in pediatric patients. American Journal of Emergency Medicine, 37, 439-443. Sporri, J., Kroll, J., Amesberger, G., Blake, O. M., & Muller, E. (2012). Perceived key injury risk factors in World Cup alpine ski racing: An exploratory qualitative study with expert stakeholders. British Journal of Sports Medicine, 46, 1059-1064. The coronavirus led to business shutdowns in an effort to contain the spread, as well as the Federal Government to pass the CARES act to help individuals and small businesses. Part of this is the Paycheck Protection Program (PPP), where banks lent money to small businesses through the Small Business Administration (SBA) with low interest and were backed by the Federal Reserve (Mercado, 2020). Generally, if at least 60% of this lent money was used to support workers, the balance of the loan could be forgiven. Overall, $525 Billion was lent through this program with the majority being smaller loans. There were 662,215 loans made to businesses in excess of $150,000 that were categorized based on level of spending and the details of the loan are publicly available (SBA). In an effort to understand who was lent money, the SBA also asked for additional details, which may not have been provided, on gender, ethnicity, veteran owned, non-profit status and lending institution.

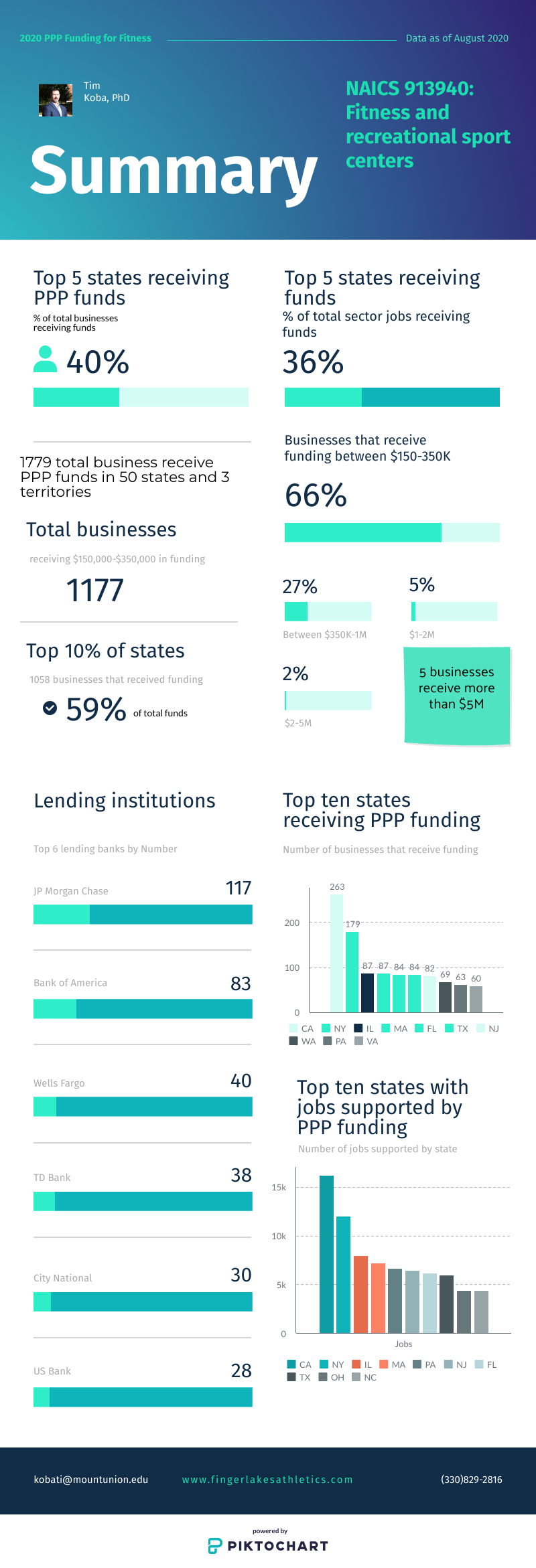

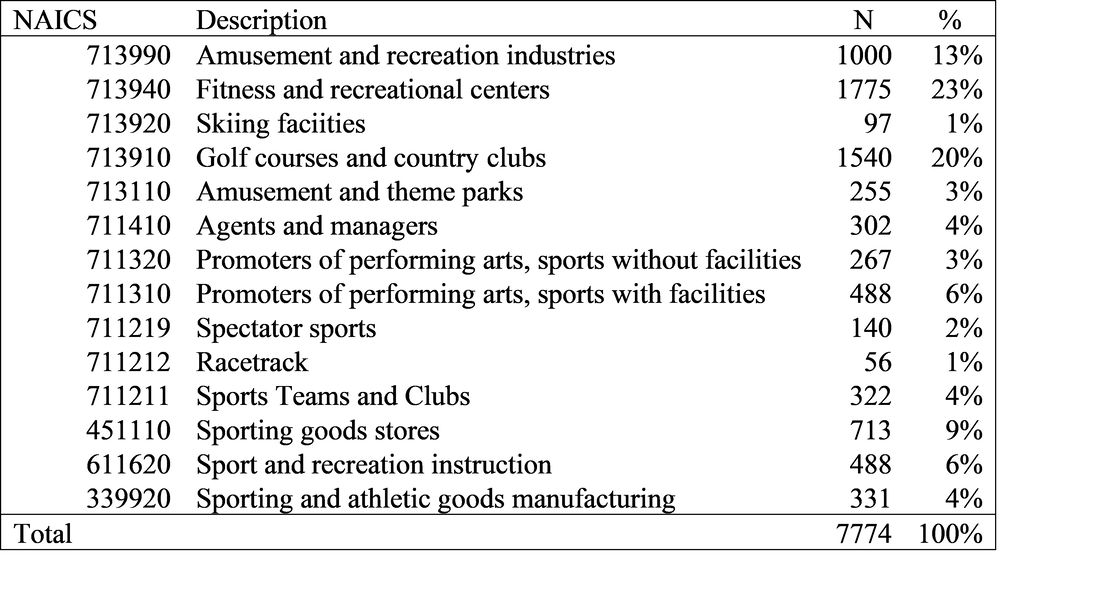

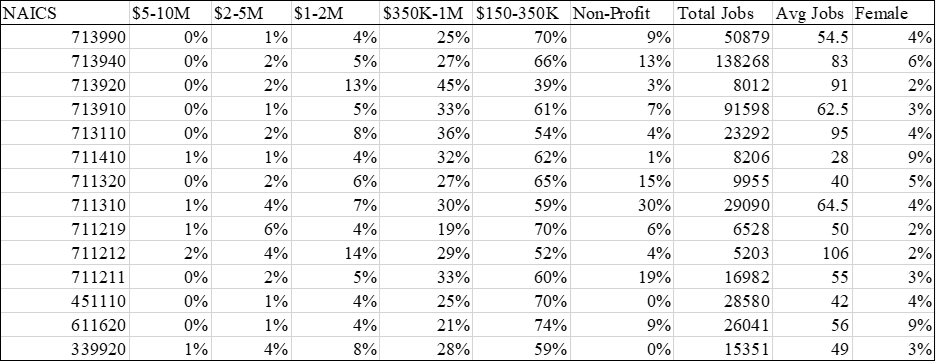

The North American Industry Classification System (NAICS) is used to classify businesses for statistical use to understand the United States Economy (U.S. Census Bureau, 2020). There are several NAICS codes that apply to sport, with the largest sector being NAICS 713940; fitness and recreational sports centers. According to NAICS data, there are 134,100 businesses in this sector which is 44% of the total number of sport and recreation related businesses (Table 1). According to leading industry trade association, the International Health, Racquet and Sportsclub Association (IHRSA), there were 39,570 gyms in 2018 (Rodriguez, 2019). Fitness and recreation were one of the sectors most impacted by the coronavirus shutdowns. To determine the PPP funds that went to the fitness and recreational sport centers, the SBA dataset was downloaded for all loans made over $150,000. This was further subdivided into the businesses that exist in the sport section and then isolated to those businesses with NAICS code 713940. The restriction to funds in excess of $150,000 was due to availability of the data, for funds less than this amount, there were higher identifiers collected and it was organized by state rather than in a single file. Results of the data illustrate that a total of 1,775 businesses in the fitness and recreational sport sector received funding in excess of $150,000 with each state, two territories (Guam and Puerto Rico) and Washington, DC represented. Funds were organized into categories with 1,177 businesses receiving funds between $150-350,000, 473 businesses receiving funds between $350,000-1 Million, 81 businesses with funding between $1-2 Million, 43 businesses with funds between $2-5Million and 5 receiving funds between $5-10 Million. There were a total of 103 (5.8%) that were listed as female owned and 217 (12.2%) categorized as non-profits. Since this was not a mandatory field to be completed, it is unknown if there were more. The states with the most businesses receiving funding are California (263), New York (179), Illinois and Massachusetts with 87 and Florida and Texas with 84. These six states represented 45% of the total businesses that received PPP funds (Table 2). Rounding out the top 10 were New Jersey (82), Washington (69), Pennsylvania (63) and Virginia (60). These ten states received 59% of the total PPP funding received for this sector. The total jobs that were supported by the PPP were 137,852. The top ten states for job support were California (16,245), New York (12,061), Illinois (7,950), Massachusetts (7,228), Pennsylvania (6,703), New Jersey (6,491), Florida (6,204), Texas (6,003), Ohio (4,413) and North Carolina (4,371). These ten states comprise 56% of the total jobs supported by PPP funding (Table 3). An assessment of the lenders show that JP Morgan Chase issued 117 loans, Bank of America issued 83, Wells Fargo issued 40, TD Bank issued 38, US Bank issued 28 and PNC Bank with 26. These are six of ten largest banks by assets in the United States (Phaneuf, 2019). City National Bank issued 30 loans, Truist and the Huntington Bank each issued 25 loans, Manufacturers and Traders Trust issued 23 loans, as did Fifth Third Bank. Unfortunately, these results do not include total funds lent to fitness and recreational sport centers, but it does provide insight into gyms that received higher levels of funds. The 1,775 businesses that received funds supported 137,852 jobs in 50 states, two territories and Washington, DC. It would appear that there are differences in where the funding went, with California and New York businesses received 25% of total funds. The top ten states of businesses receiving funding comprise 59% of total funds. The jobs supported are similar, with California and New York supporting 21% of total jobs and the top ten supporting 56% of total jobs. Two of the largest banks by assets also issued the most loans, JP Morgan Chase with 117 and Bank of America with 83. Further evaluation should attempt to determine the total number of fitness and recreational sport businesses that received funding at all levels. Since these funds are meant to provide financial support for coronavirus shutdowns and pay employees it is vital to understand the number of businesses that received these funds. Since it is also possible that these loans are eligible for forgiveness if the funds are used for approved expenses, the businesses that receive them have an advantage over those that do not. How wide spread this disparity is, is not fully known. What is known is that 66% of the funding over $150,000 was between $150-350,000. The results indicate that just 5.8% of the businesses that received funding were female owned. If this is reflective of the ownership of businesses in this sector is not known since this was not a mandatory field. If it is reflective, then much work remains to be done supporting women owned businesses in this field and their ability to acquire loans. Non-profit businesses comprised 12.2% of the total businesses. The lack of minority completed forms makes it difficult to determine the ethnic breakdown of the funds, so it would appear that more work is required. The collection and dissemination of PPP funds is helpful for understanding what businesses are receiving funds, and if this is an indication of the sector, there is a lack of female and minority owned businesses in fitness and recreational sport centers. References Mercado, D. (2020, November 2). PPP loan borrowers are being steered toward forgiveness. Why they should slow down. CNBC. https://www.cnbc.com/2020/11/02/ppp-loan-borrowers-shoved-into-forgiveness-why-they-should-slow-down.html Paycheck Protection Program loan data. (2020, August 20). U.S. Small Business Association. Phaneuf, A. (2019, August 26). Here is a list of the largest banks in the United States by assets in 2020. Business Insider. Retrieved from https://www.businessinsider.com/largest-banks-us-list Rodriguez, M. (2019, March 28). Latest IHRSA data: Over 6B visits to 39,570 gyms in 2018. IHRSA. Retrieved from https://www.ihrsa.org/about/media-center/press-releases/latest-ihrsa-data-over-6b-visits-to-39-570-gyms-in-2018/ United States Census Bureau. (2020). North American Industry Classification System. Retrieved from https://www.census.gov/eos/www/naics/ In early 2020 the global economy was impacted by COVID-19 which caused many states to institute lockdowns to restrict the spread of the virus (Maxouris, 2020). The sport industry was not immune to this impact, including the suspension of professional sports and the closing of fitness centers and gyms in many communities (Brooks, 2020). In order to help small businesses weather the economic impact that resulted from the shutdowns, the Payroll Protection Program (PPP) was launched to help provide small business with capital necessary to pay their employees and prevent small businesses from closing their doors. Those businesses that achieved funding were able to obtain loans at a small interest rate with deferred payments, as well as apply for loan forgiveness if the funds were used for eligible expenses and if certain employee criteria were met (SBA, 2020). There were several categories of funding available for small businesses with over 600,000 businesses receiving funding of over $150,000 according to the SBA PPP dataset. Since the sport industry, and fitness centers were impacted, a smaller subset of the data was created to identify the sport related businesses that receive funding. The data was organized based on the North American Industry Classification System (NAICS), which was developed for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy (U.S. Census Bureau, 2020). The data also included other information including the number of employees the business reported, the location, organizational structure, and demographic of the owner, when completed. The sport industry is spread over several NAICS codes with category 71 broadly including Arts, Entertainment and Recreation (NAICS Association, 2018), however, other specific sport related industries are included in other classification systems, or included broadly (sport apparel and footwear is included in the broader category and excluded). A summary is presented of the NAICS, description of the category and number of businesses that received funding (Table 1). Unsurprisingly, the fitness industry received the bulk of the funding that went to the sport industry with 1775 businesses receiving funding in excess of $150,000. One thousand amusement and recreational businesses received funding over $150,000 and 1540 golf clubs and country clubs received funding of more than $150,000. These three categories comprised 56% of the total sport related business that received PPP funding. Additionally, we can look at the composition of the sport businesses that received PPP funds (Table 2). The majority category of funding was $150-350,000 ranging from a low of 52% in racetracks to a high of 74% in sport and recreation instruction. Most of the businesses were for profit, however 30% of the businesses that received PPP funds in the Promoters of performing arts, sports with facilities category were non-profit. The categories that have the largest employees was the fitness industry (138,268) and golf and country clubs (91,598). The businesses with the greatest average employment were racetracks (106) and amusement parks (95), with skiing facilities (91) and fitness (83) close behind. Many businesses did not report on gender or minority status of the owners, but those that report gender demonstrate little female owned businesses. None of the sport categories exceed 10% as being female owned and only Agents and managers and Sport and recreation instruction are in the high single digits (9%). From this overview we can see that 7774 total businesses in the sport industry received PPP funding with the fitness sector, golf and country clubs and amusement and recreation comprising 56% of the businesses that received PPP dollars. The fitness industry is the dominant employer followed by golf and country clubs. This data was restricted to lending in excess of $150,000 and does not include funding below that level. It is not known how many more sport businesses received funding below $150,000. This data does let us see that the fitness center, although impacted, had the greatest number of businesses receiving PPP funding. While we can see funding level and number of businesses and jobs, we do not know how many other businesses applied for funding, received lower amounts of funding, or were not able to acquire funding and shuttered their doors. Most of the businesses are for-profit operators with limited female ownership, which may be a result of not completing that section on the application. If representative, it continues to demonstrate a disparity in women owned businesses acquiring capital. Minority funding was difficult to determine since there was a lack of completed information on the ethnicity question. Compiling complete data would allow for greater transparency and understanding of the businesses in sport that receive PPP funding for operations and employment support. A copy of the complete dataset complied the U.S. Treasury is available here References Brooks, K. J. (2020, March 17). As coronavirus spreads, gyms halt the workouts. CBSNews. Retrieved from https://www.cbsnews.com/news/fitness-clubs-and-gyms-are-closing-because-of-coronavirus/ Maxouris, C. (2020, March 18). These states have some of the most drastic restrictions to combat the spread of coronavirus. CNN. Retrieved from https://www.cnn.com/2020/03/17/us/states-measures-coronavirus-spread/index.html NAICS Association. (2018). Six digit NAICS codes & titles. Retrieved from https://www.naics.com/six-digit-naics/?code=71 Payroll Protection Program. (2020). Small Business Association. Retrieved from https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program U.S. Census Bureau. (2020, February 26 updated). North American Industry Classification System. Retrieved from https://www.census.gov/eos/www/naics/ In 2014 over 54 million Americans were paying for a gym membership averaging an attendance of 100 days a year with continued growth (Franchisehelp, 2020). When the Coronavirus pandemic spread, states instituted lock downs and the closing of fitness facilities in many states. To adapt to the changing environment, consumers shifted to workout at homes by purchasing equipment and utilizing apps. Fitness tech was one of the top trends in 2019 and this was prior to the pandemic shutdowns (IHRSA, 2019). Moreover, consumers have shifted spending by transitioning from their usual fitness facility visits to working out from home, and some have no plans to return (Business Wire, 2020).

The pandemic has been brutal for some in the fitness industry with Gold’s Gym, 24 hour fitness, Town Sports International and Flywheel among those to declare bankruptcy in the industry (Evans, 2020). Not all in the industry have suffered, however, with at home providers benefitting from the shutdowns in terms of growth and revenue (Reuters, 2020). Among these has been Peloton. Peloton was uniquely positioned to benefit from the pandemic. Their core product is connected devices (bikes and treadmills), but they had made a strategic decision to increase their streaming services prior to the pandemic. This investment was made in attracting fitness personalities and expanding both user content to include yoga, strength and meditation in addition to their connected equipment. One of the most well known at home fitness providers is Beachbody, which includes brands like P90X, T-25 and PiYo, with talented fitness personalities, was one of the early entrants in at home fitness and fitness on demand. However, the pricing for the Beachbody is $100 a month to access a full fitness library. Peloton, on the other hand, sells a digital membership of $12.99, which includes the ability to take live streamed classes, as well as access to a library of high production workouts on demand. This shifting marketplace has also attracted a new entrant with Apple introducing their Fitness+ product that will integrate their watch, tv, and health stats by allowing consumers to stream workouts and see real time stats synced from their watch to their device. Users will be able to access this for $9.99, or a complete suite of Apple products for $29.99. While Peloton CEO, Foley, has said that Apple’s entry into the market legitimizes the market (Thomas, 2020), they also pose a threat for those brands in existence. Peloton may have been the first to market with their connected services and re-creation of a live class and feeling of community, but this is not hard to replicate and Apple has the financial ability to do so, if they desire. The difficulty for Peloton and others is that fitness is their core industry and they are reliant on the ability to grow revenue within this sector. Apple, on the other hand, does not need fitness to be successful, their revenue is from the sale of devices. Fitness+ is a continuation of their entry into production after launching Apple TV. They do not need these streams to be profitable, since any loss incurred is off set by the revenue generated of their core products. Their user reach also makes it feasible to make an investment in producing their own product, and they can pre-load their own apps on devices they sell, providing them an advantage over other businesses. While they are in the early faces of their product creation, it is still early enough for them to be successful. One of the variables that they need to be aware of is the importance of the personality of the trainer doing the video. With at home workouts, the personality is paramount, and Beachbody and Peloton have an advantage. Once again, Apple has the cash available to make an investment, and in so doing, may exceed the 3 million users that Peloton currently has. Apple may also be utilizing the fitness sector as a way to gain data and legitimize their watch as a health tool. If Apple is able to generate data on users who are both healthy, and unhealthy, they can use that information to customize algorithms to determine a variety of health risks. The watch will then be able to offer alerts, sync with physician practices and enable Apple to use the watch as a means of ushering in an era of connected health care. Apple may also be testing the waters to determine the long term viability of fitness on demand. Since this sector is not a major revenue source, the risk of entry is low, but the potential for upside growth is large, making it worth the investment. If this sector continues to grow, Apple may look to expand their holding by acquiring other businesses in this sector and creating their own linked network of equipment, watches, programming and data. If, indeed, fitness from home is not a fad, then Apple will be positioned to capitalize on the longer-term growth potential. Previously successful retail fitness locations have been suffering prior to the pandemic, but if a shift results in a market move, there will be even more closures. Fitness on demand will offer the content, convenience and safety that consumer desire. Even at home, these companies have been able to create a community to replace the socialization that some participants crave. Companies that offer quality programming, with talented personalities will continue to be successful. Apple has the cash, technological know-how and consumer base to successfully profit in the future. Other brands need to understand their threat to entry and establish a risk mitigation strategy to capitalize on their current user base and grow it in the future. References BusinessWire. (2020). Consumer fitness survey finds post COVID-19, billions in spend will be lost or reallocated in massive industry transformation. https://www.businesswire.com/news/home/20200526005202/en/Consumer-Fitness-Survey-Finds-Post-COVID-19-Billions-in-Spend-Will-Be-Lost-or-Reallocated-in-Massive-Industry-Transformation Evans, P. (2020, Sept. 15). Spinning out. Front Office Sports. https://frontofficesports.com/spinning-out-flywheel/ Franchisehelp. (2020). Fitness industry analysis 2020: Cost and trends. https://www.franchisehelp.com/industry-reports/fitness-industry-analysis-2020-cost-trends/ IHRSA. (2020). 2019 fitness industry trends shed light on 2020 and beyond. https://www.ihrsa.org/improve-your-club/industry-news/2019-fitness-industry-trends-shed-light-on-2020-beyond/ Reuters. (2020, Sept. 10). Peloton revenue surges as pandemic boosts demand for fitness equipment. New York Post. https://nypost.com/2020/09/10/peloton-revenue-surges-as-pandemic-boosts-demand-for-fitness-equipment/ Thomas, L. (2020, Sept. 15). Peloton CEO on Apple launching workout service: “It’s quite a legitimization of fitness content”. CNBC. https://www.cnbc.com/2020/09/15/peloton-ceo-on-apple-launching-workouts-a-legitimization-of-fitness-content.html The ability to make sales of your product or service are vital to your long term operational success. Yet, organizations still struggle with communicating their product and initiating a sale. While many organizations collect plenty of data on their consumers, they struggle to utilize that for a strategic purpose. The cost of attracting a new consumer is higher than retaining an existing consumer, or moving an existing consumer to higher levels of brand attachment. This means every person entering your facility has the potential to be a new customer.

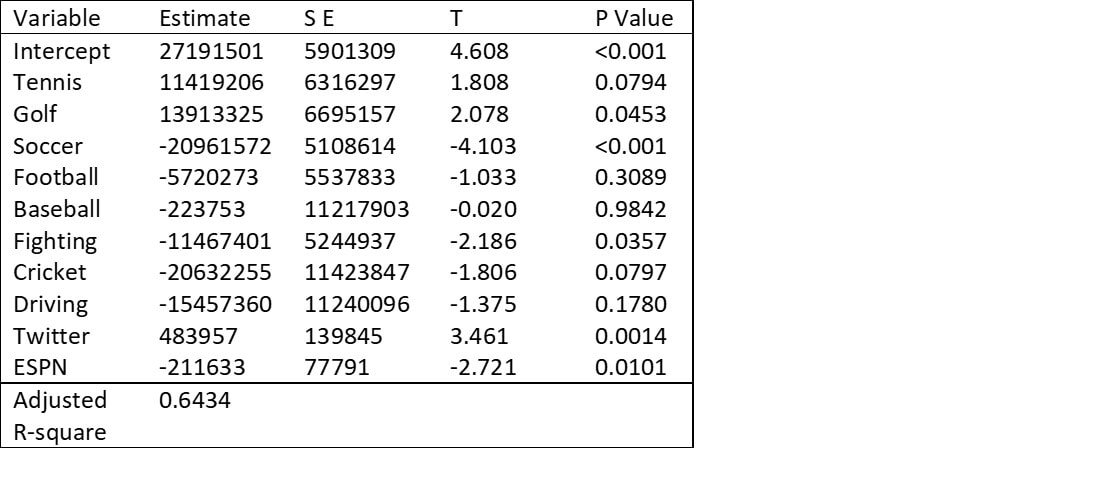

Once contact has been made with a prospect, what plan is in place to acquire them? When utilizing CRM software, it is important to customize the message and have a strategic follow up, which may take several touch points, according to ABC Financial's Aaron Verasammy. Each message should be customized to the prospect depending on their unique needs and interests regarding your product. Unfortunately, while the importance of sales is apparent to the industry, there is a lack of adequate training (Popp, Simmons, & McEvoy, 2017). If larger sport organizations suffer with sales training, how can smaller businesses succeed? They can start with having a plan of how they collect consumer and prospect information and put that to use. When a potential consumer enters the facility, is there a schedule of events that an associate can reference? Are the staff members prepared to discuss the various programs and offers, or know who to refer these questions to in order to grow the consumer base? Does the business collect contact information and follow up with a customized message discussing the prospect's interests? If not, why not? Many sales opportunities are lost by capitalizing on the engagement of a captive audience. Once the prospect leaves they may not come back. However, if there is a plan in place to capitalize on their engagement, a new consumer may be realized. This may come as a result of a targeted email thanking them for coming or visiting and providing information specific to their interests. Other options include an invitation and promotional offer for a future visit or program, referral of a friend, hashtag for social media posting if applicable and appropriate. Whatever follow up message is chosen, it is important to have one. If a prospect leaves without a prompt for a future visit they may be gone for good. Don't let that happen to you. Think about how you want to engage your prospects and employees, have a plan, train your team and implement the strategy to attract and grow your client base. Do: Have a plan Train your staff Customize your message to each potential customer Don't: Lose the opportunity Neglect to train your staff Hope the prospect will come back on their own References Popp, N., Simmons, J., & McEvoy, C. (2017). Sport ticket sales training: Perceived effectiveness and impact on ticket sales results. Sport Marketing Quarterly, 26, 99-109. Verasammy, A. (2020). 5 must do's to accelerate growth. Club Industry Master Class Series.  We know that athlete endorsers can generate substantial additional revenue from their corporate partnerships, but what determines the magnitude? Most people can name several elite performers in their sport who are also key brand endorsers, but what about others? Is there an increase for playing a certain sport, having more followers or being more popular? In order to determine this, a regression analysis was conducted on the top 100 athlete endorsers of 2019 as named by Opendorse. This website listed 2019 endorsement earnings, sport and number of Twitter followers. Next, athlete popularity was collected from ESPN who ranks the top 100 athletes by popularity. Finally, a model was run looking at earnings as determined by the sport played (with basketball as the reference sport), number of Twitter followers (in Millions) and ESPN rank (1 most popular). The results indicate that compared to basketball, tennis athlete endorsers receive an additional $11 million, golf receives about $14 million more, while crticket and soccer each receive about $21 million less and fighters receive $11 million less than basketball, with football, baseball and driving showing no difference in endorsement income. For every 1 million increase in Twitter followers, an athlete can expect to receive an $480,000 and as popularity drops, so does the amount they receive, about $200,000 per drop in rank. Overall, these results provide some evidence that not all sports are equal in terms of attracting endorsement dollars. Some sports command a premium over others. Athletes who are interested in generating additional income should be encouraged to cultivate their social media following as they are rewarded for a larger audience, which makes sense for endorsing companies trying to increase their reach. While this model predicts about 64% of endorsement dollars, there are several other features that are potentially contributing to endorsement dollars that isn’t captured. The more that athletes, their agents, and endorsing companies, understand what impacts endorsement earnings, the better able each is to represent their interests to greatest advantage. Depending on the sport, athletes can generate substantial additional income as an athletic endorser, sometimes exceeding their contracts (Smith, 2019). Athletes have historically been used as a spokesperson, or endorser, for firms in the past hoping to capitalize on their appeal to their target market. In exchange for their endorsement, athletes would be compensated. Now, it is not unusual to hear that an athlete obtains an equity stake in company they endorse. If an athlete has an ownership stake in a business they partner with they have a vested interest in their performance and are more likely to actively promote the brand. As pointed out in a Sportico article, the use of equity for compensation can be expensive (John WallStreet, 2020).

The equity stake does not have to contain money up front, but as the brand grows and prospers, so does that stake. So, while the company may have cash now to reinvest in operations, or seek additional marketing strategies, the equity can be costly to the current owners over time. Moreover, any equity stake comes with an ownership vote in the future of the company. While perhaps not a threat now, it can pose a challenge if the athlete disagrees with ownership in the future and their is a public rift. Their is also additional risk to a brand in the activities of a sponsor may reflect back on a brand. It is not known how having an athlete owner will reflect on the company if their is a negative behavior attributed to the athlete. For high profile athletes with a positive rating, the potential for income is apparent, as they stand to generate millions of additional dollars in income (Rascher, Eddy, & Hyun, 2017). These athletes have an interest in maintaining their popularity as it allows them to negotiate for higher endorsement fees. As this cost rises, companies may be averse to paying them cash, and so opt for some mix of equity in exchange for their endorsements. As this landscape continues to evolve and athletes continue to look beyond their playing careers to build future financial portfolios, the use of equity to pay for endorsements will probably continue to grow. Brands will be faced with trying to determine not just how much an endorsement contract is worth, but how much a piece of the company is. References Rascher, D., Eddy, T., & Hyun, G. (2017). What drives endorsement earnings for superstar athletes? Journal of Applied Sport Management, 9(2). Smith, N. (2019, June 17). 13 athletes who make more money endorsing products than playing sports. Business Insider. Retrieved from https://www.businessinsider.com/athletes-endorsements-nba-golf-tennis-2019-6 Sportico. (2020). Start-ups, challenger brands leaning on equity-for-endorsement deals, despite soft market. Retrieved from https://view.email.sportico.com/?qs=a7e127b8dd8af188e5ed7117fc6bda871e1beb8f88758bf397e3bd0afb2ba8298ab7d347dee925944f4afda5b010a214ca050ef5f7761b1f9a00793476f784ce570e6b08dabf65cf |

AuthorI write on sport management, fitness, sports medicine and business topics to help you reach your goals Archives

February 2024

Categories

All

|

||||||

|

Home

About Contact |

To learn more about what services we offer, to schedule an appointment or to get prices please contact me at

[email protected] (607)279-6791 *This site is for educational purposes only, it is not meant to diagnose, treat or replace medical advice. Before starting an exercise program always make sure that you are healthy and able to do so safely.* |

RSS Feed

RSS Feed